The digital underground economy is thriving, and one of the core contributors to this rise is platforms linked with activities like those reported around Ultimate Shop. These online spaces facilitate the buying and selling of illegal card data, such as dumps and CVV2 information, creating a vast network of financial fraud that affects people worldwide. Understanding how these systems work is essential in preventing the next wave of cybercrime.

Dumps are typically obtained through skimming devices, malware, or data breaches and include full track data of cards. CVV2 codes, often acquired through phishing or hacking, allow online transactions to bypass physical card requirements. When these are sold on forums linked to Ultimate Shop, they enable criminals to clone cards or make unauthorized online purchases.

One of the primary ways platforms like this fuel the underground economy is through the ease and efficiency with which stolen data is traded. What was once a complicated operation requiring physical access to cards has turned into a digital marketplace where a few clicks can grant access to thousands of compromised accounts. This lowers the entry barrier for fraudsters and increases the frequency of attacks.

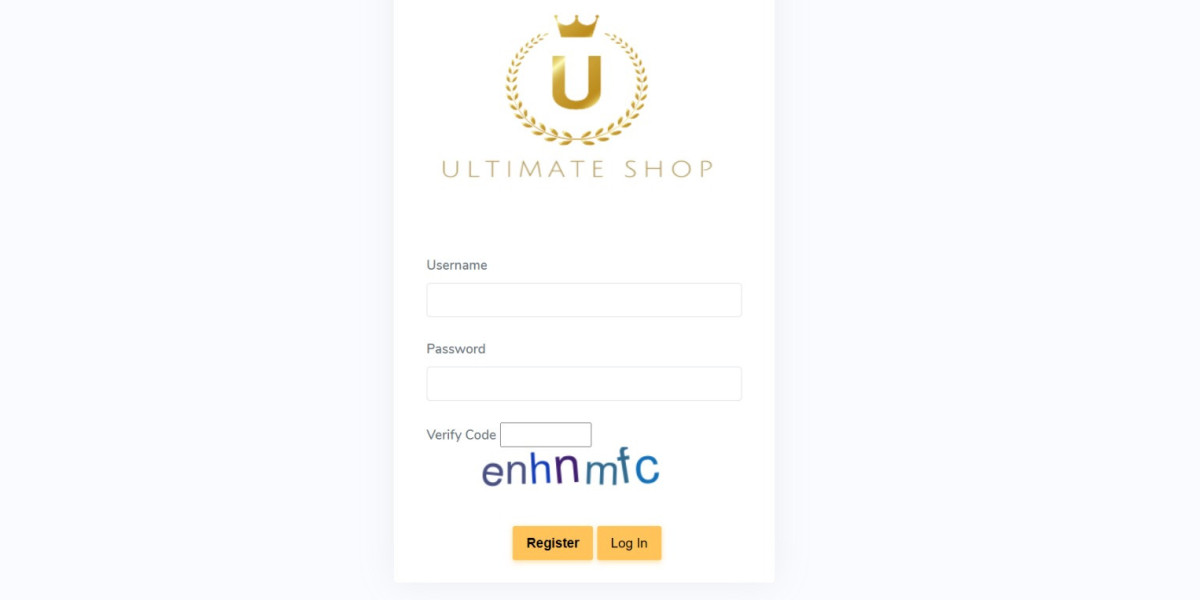

These operations often run like legitimate businesses—offering customer support, bulk discounts, and user reviews to establish trust among buyers. This commercialization of crime normalizes fraudulent behavior in certain circles, further feeding the cycle of theft and abuse. The more organized and structured these shops become, the more difficult it is to dismantle them.

Victims of this economy are not limited to individual cardholders. Retailers, payment processors, and financial institutions also suffer losses. Fraudulent transactions lead to chargebacks, reputational damage, and the need for increased investment in cybersecurity infrastructure. Ultimately, these costs are passed down to consumers in the form of higher fees and restricted services.

Law enforcement agencies are working hard to track these activities, but the constantly changing web addresses, encrypted communication channels, and use of cryptocurrencies make enforcement a complex task. Even so, international efforts have led to the takedown of many such platforms, highlighting that digital criminals are not beyond the reach of the law.

Education and vigilance are crucial tools in combating the influence of platforms tied to card fraud. People need to be wary of unsolicited messages asking for card information and should use secure payment systems. Businesses should adopt a zero-trust model, conduct regular audits, and educate staff about potential cyber threats.

The bottom line is that platforms like Ultimate Shop thrive on the weaknesses in our digital behavior. Whether it’s a careless click or outdated software, every small lapse can be an opportunity for fraud. By understanding how these platforms function, we can all play a part in making the digital world safer for everyone.