In recent years, digital fraud has grown at an unprecedented rate, with cybercriminals finding newer, more advanced ways to steal financial data. Among the many elements contributing to this rise is the emergence of marketplaces known for trading sensitive information like dumps and CVV2 codes. One such name that has repeatedly surfaced in discussions about digital fraud is Ultimate Shop.

For those unfamiliar, “dumps” refer to raw credit card data, especially information contained on a card’s magnetic stripe. These can be obtained through skimming devices or data breaches and then sold to others who use them to clone cards. On the other hand, CVV2 data—the three-digit code on the back of a credit card—is critical for online transactions. When both dumps and CVV2s are available together, it becomes much easier for fraudsters to carry out unauthorized purchases, often before the legitimate cardholder even realizes their data has been compromised.

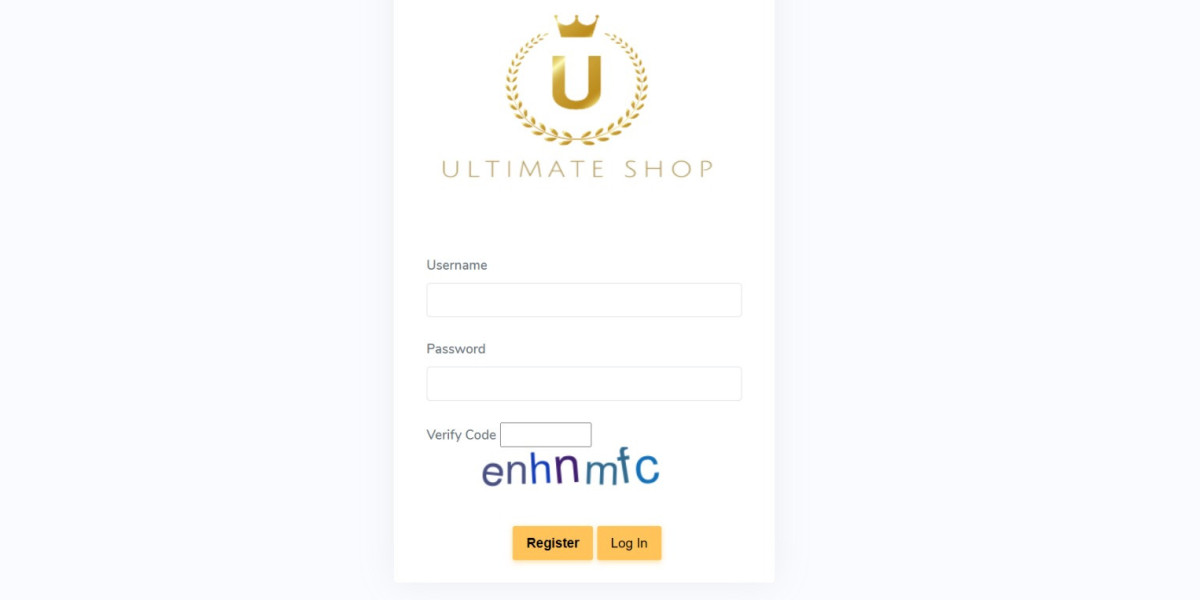

Ultimate Shop is widely associated with offering such compromised data in bulk. These platforms often function like conventional online stores. They feature user-friendly interfaces, customer support, inventory sorting, and even bulk discounts. But instead of selling consumer goods, they traffic in stolen financial details, fueling a dangerous underground economy.

The growing ease of access to dumps and CVV2 data on sites like Ultimate Shop has significantly lowered the barrier for entry into cybercrime. Even individuals with limited technical knowledge can now participate in fraud by purchasing data and using it for carding—buying products online with stolen cards. These individuals often remain anonymous through cryptocurrency payments, encrypted communications, and dark web browsers, making it harder for authorities to track their activities.

This underground activity doesn’t just affect individual victims. It places a major burden on banks, merchants, and financial institutions. Chargebacks from unauthorized transactions cost companies billions every year. Meanwhile, consumers are left scrambling to cancel cards, recover funds, and repair credit scores. In many cases, the emotional toll of financial fraud can be just as heavy as the financial loss.

To fight this growing threat, it’s crucial for both businesses and consumers to stay informed. Financial institutions are now deploying advanced AI tools to detect suspicious transactions more quickly. Retailers are investing in more secure payment systems to prevent skimming and data theft. On the consumer side, awareness is key. Simple actions like monitoring account activity, enabling alerts, and using multi-factor authentication can make a big difference.

Ultimately, the presence of platforms like Ultimate Shop reflects a deeper shift in how cybercrime operates today. The internet has not only connected the world but also given rise to a new marketplace where stolen data is just another product. Understanding this shift is the first step toward defending against it. Everyone—from the everyday shopper to the cybersecurity expert—has a role to play in keeping financial systems secure.