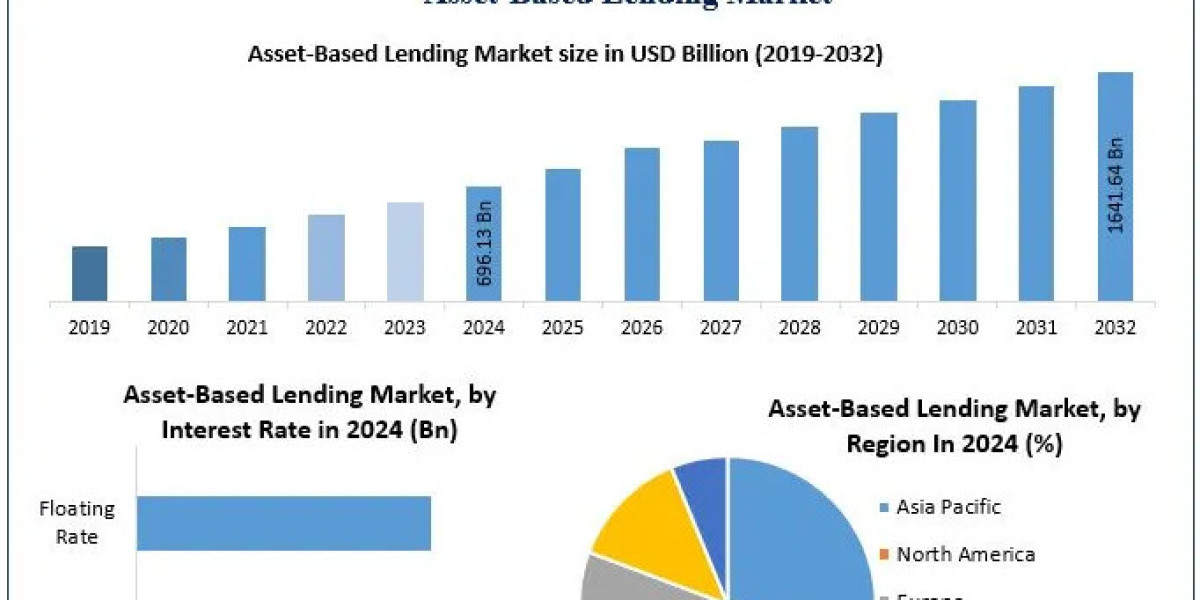

Global Asset-Based Lending Market Set to Surpass USD 1.64 Trillion by 2032 Driven by Demand for Working Capital, SME Growth, and Fintech Expansion

The global Asset-Based Lending (ABL) Market, valued at approximately USD 696.13 billion in 2024, is on an accelerated growth trajectory and is projected to reach USD 1.64 trillion by 2032, growing at a CAGR of 11.32% during the forecast period. This surge is powered by evolving borrower needs, fintech disruptions, and a growing shift away from traditional credit models.

To know about the Research Methodology :https://www.maximizemarketresearch.com/request-sample/189641/

Market Estimation & Definition

Market Definition:

Asset-Based Lending (ABL) refers to a secured loan solution where companies obtain financing by pledging assets such as receivables, inventory, equipment, or real estate as collateral. Unlike unsecured lending, which relies on credit ratings or cash flow, ABL is governed by the value and liquidity of the borrower’s assets. It is widely used by mid-sized to large enterprises and increasingly by SMEs, particularly those with valuable but illiquid balance sheets.

Market Size:

The ABL market reached a valuation of USD 696.13 billion in 2024 and is forecasted to exceed USD 1.64 trillion by 2032, reflecting increased market confidence and adoption across industries. The robust CAGR of 11.32% illustrates the expanding role of ABL in modern finance.

Market Growth Drivers & Opportunities

Growing Demand for Working Capital:

In today’s fast-paced global economy, businesses are under constant pressure to maintain liquidity and operational efficiency. ABL provides a reliable avenue to unlock capital tied up in inventory and receivables, helping companies to manage cash flow without increasing leverage.

Rising Interest Rate Environment:

In response to rising interest rates, traditional unsecured loans have become more expensive and less accessible, especially for riskier borrowers. ABL offers an alternative with relatively lower risk for lenders, enabling them to offer competitive terms to borrowers with strong asset portfolios.

SME Financing Needs:

Small and medium-sized enterprises often face challenges accessing credit due to limited credit histories or insufficient financial documentation. ABL serves as an inclusive solution, allowing SMEs to leverage their assets for growth financing, bridging the funding gap in underserved segments.

Fintech Integration and Digitalization:

Technological advancements in asset valuation, risk analytics, and digital documentation are transforming ABL into a seamless, scalable lending option. The rise of digital platforms allows quicker approvals, transparent monitoring, and a broader reach into emerging markets.

Diversification of Collateral Types:

Lenders are increasingly open to alternative forms of collateral, including intellectual property, digital assets, and subscription-based revenues. This flexibility enables companies from tech, media, and service industries to benefit from asset-backed financing models.

Globalization and Cross-Border Lending:

As businesses expand globally, the ability to secure financing based on international asset holdings becomes critical. Asset-based lending structures are evolving to support cross-border trade and multinational operations, expanding the scope of ABL beyond domestic markets.

Segmentation Analysis

Based on the report’s insights, the Asset-Based Lending Market is segmented by:

1. Collateral Type:

Accounts Receivable: The most common form of collateral, widely used due to its liquidity and value predictability.

Inventory: Growing in importance, especially for retail, e-commerce, and manufacturing firms with significant stockholding.

Equipment: Fixed assets such as machinery or vehicles are used in capital-intensive sectors for large-ticket lending.

Real Estate: Utilized primarily for long-term or high-value loans, especially among large enterprises.

2. Loan Structure:

Term Loans: Fixed duration and interest structure; preferred by businesses for capital expenditure or expansion projects.

Lines of Credit: Flexible drawdown facilities offering liquidity as needed; suitable for managing short-term operational costs.

Revolving Credit Facilities: Allows re-borrowing as repayments are made; ideal for ongoing financing needs and seasonal cash flow management.

3. Borrower Size:

Large Enterprises: Command the highest market share due to significant asset holdings and larger borrowing needs.

Small and Medium Enterprises (SMEs): Represent a fast-growing segment, particularly in developing markets and underbanked regions.

Each segment caters to different financing needs, with the market showing increased diversification and personalization of asset-backed financial products.

Request Free Sample Report:https://www.maximizemarketresearch.com/request-sample/189641/

Country-Level Analysis: USA & Germany

United States:

The U.S. holds a dominant share of the global ABL market, owing to its advanced financial infrastructure, well-developed legal framework, and robust private credit ecosystem. The country is home to numerous ABL providers, ranging from traditional banks to specialized private lenders and fintech firms. High interest rates and increasing pressure on corporate balance sheets have driven both large enterprises and SMEs toward ABL products.

In recent years, there has been a notable uptick in inventory and receivables financing, particularly in the retail, logistics, and healthcare sectors. The integration of analytics and AI by fintech lenders has further enhanced risk management and asset tracking capabilities, contributing to market maturity and expansion.

Germany:

Germany is one of the leading asset-based lending markets in Europe. With a strong base of manufacturing, automotive, and industrial companies, ABL is widely used to finance operations and investments. German SMEs, which constitute the backbone of the country’s economy, increasingly rely on ABL to address liquidity challenges.

The country also benefits from supportive financial regulations and an efficient collateral registration system. Emerging trends in Germany include the growing popularity of IP-based and equipment financing, as businesses in the technology and clean energy sectors seek flexible funding mechanisms.

Commutator Analysis

To better understand the internal and external forces shaping the market, here is a comprehensive COMMUTATOR analysis:

C – Catalyst: Increasing need for working capital, tightening credit markets, and the shift toward collateral-based lending.

O – Opportunity: Expansion in emerging markets, fintech innovation, growing SME demand, and acceptance of non-traditional collateral.

M – Main Strength: Strong asset security, lower credit risk for lenders, higher borrowing potential for asset-rich businesses.

M – Main Weakness: Dependence on accurate asset valuation; risks associated with asset depreciation or illiquidity.

U – Uncertainty: Economic downturns affecting asset value; regulatory shifts; volatility in borrower performance.

T – Threat: Rebound of traditional lending practices post-stabilization of interest rates; cybersecurity threats to digital platforms.

A – Advantage: Greater inclusion for SMEs, enhanced risk visibility, speed and transparency in digital lending platforms.

T – Trend: Growth of private credit, embedded finance models, AI-powered underwriting, and collateral diversification.

O – Outlook: Bright near-term and long-term prospects, especially as global credit structures adapt to a post-traditional finance era.

R – Risk: Market saturation, rising competition, potential asset bubbles, and dependence on economic cycles.

Conclusion

The Asset-Based Lending Market is undergoing a transformative evolution. From its traditional role as a last-resort financing tool, ABL is now a preferred and strategic funding choice for companies seeking scalable, secure, and cost-effective credit solutions. With a market size poised to surpass USD 1.64 trillion by 2032 and double-digit CAGR, the future of ABL is marked by innovation, inclusion, and integration.

As digital tools redefine asset valuation and private capital plays a larger role, both lenders and borrowers are discovering unprecedented opportunities in the asset-backed model. The U.S. and Germany are at the forefront of this transformation, with broader global participation expected to fuel sustained momentum.