"Executive Summary Japan Tax IT Software Market :

Data Bridge Market Research analyses that the Japan tax IT software market is expected to reach a value of USD 4.66 billion by 2032, from USD 2.58 billion in 2024, growing at a CAGR of 7.7% during the forecast period of 2025 to 2032.

The comprehensive Japan Tax IT Software Market research report is organized by collecting market research data from different corners of the globe with an experienced team of language resources. This market report is a proven and consistent source of information which gives telescopic view of the existing market trends, emerging products, situations and opportunities that drives business towards the success. Market status at a global and regional level about industry is offered through this business report which helps gain business insights at the extensive marketplace. Japan Tax IT Software Market is the most pertinent, unique, fair and commendable market research report framed by focusing on specific business needs.

An effective Japan Tax IT Software Market report gives wide-ranging analysis of the market structure and the evaluations of the various segments and sub-segments of the industry. In this market research report, industry trends are plotted on macro level which helps clients and the businesses comprehend market place and possible future issues. All statistical and numerical data included in the report is characterized with the help of graphs and charts which makes it easy to understand the facts and figures. In addition, Japan Tax IT Software Market analysis report provides plentiful insights and business solutions with which business can stand apart from the other market players.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Japan Tax IT Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market

Japan Tax IT Software Market Overview

**Segments**

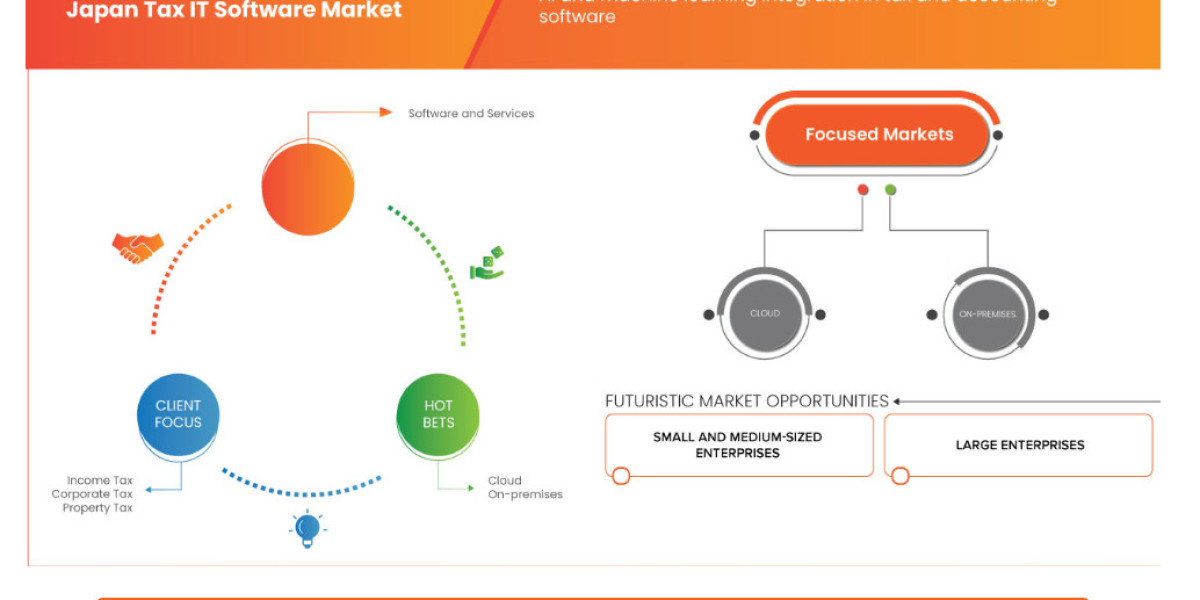

- Based on Component: Software, Services

- Based on Deployment Model: Cloud, On-Premises

- Based on End-User: Enterprises, Government

The Japan tax IT software market is segmented based on various factors that influence the adoption and growth of tax software in the country. Firstly, the market is segmented based on component into software and services. The software segment includes the actual tax software solutions that help in tax preparation, filing, and compliance. On the other hand, the services segment includes various support services such as implementation, training, and consulting services related to tax IT software. Secondly, the market is segmented based on deployment model into cloud-based and on-premises solutions. The cloud-based deployment model is gaining traction in Japan due to its scalability, flexibility, and cost-effectiveness. Lastly, the market is segmented based on end-user into enterprises and government sectors. Enterprises across various industries are increasingly adopting tax IT software to streamline their tax processes and ensure compliance, while government organizations use tax software to efficiently manage tax collection and reporting.

**Market Players**

- Intuit Inc.

- Thomson Reuters

- Wolters Kluwer

- Xero Limited

- Avalara

- ADP, LLC

- Drake Software

- Canopy Tax, Inc.

- TurboTax

- H&R Block

Key market players in the Japan tax IT software market play a crucial role in driving innovation, competition, and market growth. Companies such as Intuit Inc., Thomson Reuters, and Wolters Kluwer are well-established players with a strong presence in the global tax software market. These companies offer a wide range of tax IT software solutions tailored to the specific needs of Japanese businesses and government entities. Additionally, emerging players like Xero Limited, Avalara, and Canopy Tax, Inc. are also expanding their market presence in Japan by offering advanced tax technology solutions that address the evolving tax regulations and compliance requirements in the country. Overall, the market players in the Japan tax IT software market are continuously investing in research and development to enhance their product offerings and stay ahead in the competitive landscape.

The Japan tax IT software market is witnessing significant growth driven by various factors such as the increasing complexity of tax regulations, the need for efficient tax management solutions, and the growing adoption of digital technologies. One of the key trends shaping the market is the shift towards cloud-based tax software solutions. Cloud deployment offers benefits such as enhanced scalability, flexibility, and accessibility, making it increasingly popular among enterprises and government organizations in Japan. With the evolving regulatory landscape and the focus on digital transformation, businesses are looking for tax software that can seamlessly integrate with their existing systems and provide real-time updates and insights.

Another noteworthy trend in the Japan tax IT software market is the rising demand for AI and automation capabilities in tax solutions. AI-powered tools can help streamline tax processes, improve accuracy, and optimize compliance efforts. With the increasing volume of tax data and the need for faster decision-making, AI-driven tax software is becoming essential for businesses seeking to stay competitive in the market. Market players are investing in AI and machine learning technologies to develop advanced tax solutions that can deliver personalized insights, predictive analytics, and automated compliance features.

Moreover, the market is witnessing a growing focus on data security and compliance due to the increasing concerns around data breaches and cyber threats. Tax software vendors are incorporating robust security measures such as encryption, multi-factor authentication, and data monitoring to ensure the confidentiality and integrity of sensitive tax information. Compliance with data protection regulations such as GDPR and the Personal Information Protection Law is becoming a top priority for both vendors and end-users in the Japan tax IT software market.

As the market continues to evolve, strategic partnerships and collaborations are expected to play a crucial role in driving innovation and market expansion. Market players are forming alliances with technology providers, consulting firms, and regulatory bodies to co-develop solutions that address the specific tax challenges faced by Japanese businesses. Cross-industry collaborations are also becoming common, with tax software vendors working closely with financial institutions, accounting firms, and government agencies to deliver comprehensive tax management solutions.

Overall, the Japan tax IT software market is poised for significant growth in the coming years, driven by factors such as digital transformation, regulatory changes, and the increasing focus on efficiency and compliance. To succeed in this competitive landscape, market players need to focus on innovation, customer-centricity, and strategic partnerships to differentiate their offerings and meet the evolving needs of businesses and government organizations in Japan.The Japan tax IT software market is experiencing robust growth propelled by several factors that are reshaping the landscape. One of the significant trends influencing the market is the increasing demand for cloud-based tax software solutions. The cloud deployment model provides enhanced scalability, flexibility, and accessibility, which are appealing to enterprises and government entities in Japan looking to streamline their tax processes. As digital transformation becomes a key focus for businesses, the shift towards cloud-based solutions is expected to continue, driving further adoption in the market.

Additionally, the integration of AI and automation capabilities into tax solutions is emerging as a prominent trend in the Japan tax IT software market. AI-powered tools have the potential to optimize tax processes, enhance accuracy, and facilitate compliance efforts. With the escalating volume of tax data and the need for timely decision-making, AI-driven tax software is becoming a necessity for organizations aiming to maintain a competitive edge. Market players are investing in developing AI and machine learning technologies to deliver more sophisticated tax solutions that offer personalized insights, predictive analytics, and automated compliance features.

Furthermore, data security and compliance are increasingly becoming top priorities in the Japan tax IT software market due to rising concerns regarding data breaches and cybersecurity threats. Tax software vendors are incorporating robust security measures such as encryption, multi-factor authentication, and real-time data monitoring to safeguard sensitive tax information. Adherence to data protection regulations like GDPR and the Personal Information Protection Law is crucial for both vendors and end-users. Ensuring data security and compliance will continue to be a focal point for market players as they strive to earn the trust of businesses and government organizations in Japan.

Moreover, strategic partnerships and collaborations are anticipated to play a pivotal role in driving innovation and expanding market reach in the Japan tax IT software sector. Market players are forging alliances with technology providers, consultancy firms, and regulatory bodies to co-create solutions that address the unique tax challenges faced by Japanese enterprises. Cross-industry collaborations are also on the rise, with tax software vendors collaborating closely with financial institutions, accounting firms, and government agencies to deliver comprehensive tax management solutions tailored to specific industry requirements.

In conclusion, the Japan tax IT software market is poised for substantial growth driven by factors such as digital transformation, regulatory changes, and the increasing emphasis on efficiency and compliance. To excel in this dynamic market environment, market players must prioritize innovation, customer-centric approaches, and strategic partnerships to differentiate their offerings and cater to the evolving needs of businesses and government entities in Japan effectively.

The Japan Tax IT Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Influence of this Japan Tax IT Software Market:

- Comprehensive assessment of all opportunities and risk in this Japan Tax IT Software Market

- This Japan Tax IT Software Marketrecent innovations and major events

- Detailed study of business strategies for growth of the this Japan Tax IT Software Market leading players

- Conclusive study about the growth plot of the Market for forthcoming years

- In-depth understanding of this Japan Tax IT Software Market particular drivers, constraints and major micro markets

- Favorable impression inside vital technological and market latest trends striking this Japan Tax IT Software Market

- To provide historical and forecast revenue of the Japan Tax IT Software Marketsegments and sub-segments with respect to four main geographies and their countries- North America, Europe, Asia, and Rest of the World (ROW)

- To provide country level analysis of the Japan Tax IT Software Market t with respect to the current market size and future prospective

Browse More Reports:

North America Neurosurgery Market

North America Active Wound Care Market

Global Flexible Polyvinyl Chloride (PVC) Films and Sheets Market

Asia-Pacific Inflation Device Market

Asia-Pacific Nasal Spray Market

Middle East and Africa Rett syndrome Market

Global Organic Baby Food Market

Global Electromagnetic Tracking Systems Market

Global Helicopter Simulator Market

Asia-Pacific Fall Protection Market

Global Residential Intellectual and Development Disability Care Market

Global Passive Optical Local Area Network (LAN) Market

Global Nature Sports Market

Global Physical Identity and Access Management Market

Global Anesthesia, Respiratory and Sleep Therapy Devices Market

Global Lanthanum Nitrate Market

Global Diabetic Macular Edema (DME) Market

Asia-Pacific Application Programming Interfaces (API) Management Market

Global Industrial Services Market

Middle East and Africa Chromatography Columns Market

Middle East and Africa Food Authenticity Testing Market

Global Automated Test Equipment Market

Middle East and Africa Blood Screening Market

Global Recycled Packaging Market

Global Furfuryl Alcohol Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com