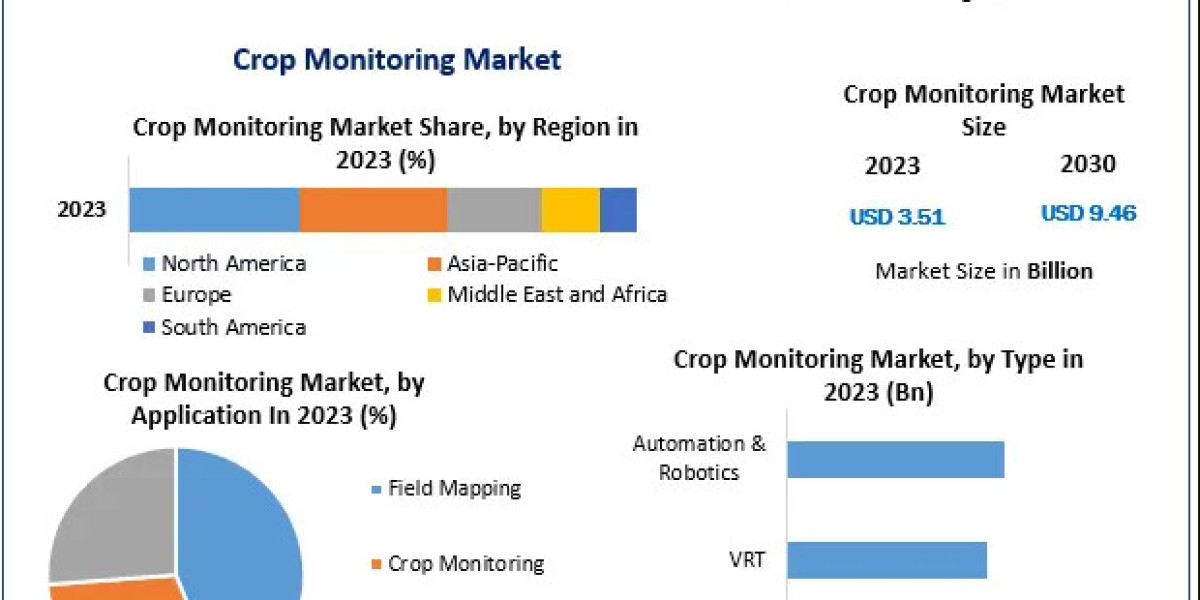

Global Crop Monitoring Market Set to Surpass USD 10 Billion by 2032 Amid Rising Demand for Precision Agriculture

The global Crop Monitoring Market is undergoing a transformation, fueled by technological advancements, climate uncertainties, and the global need for sustainable agriculture. Valued at approximately USD 3.3 billion in 2024, the market is projected to surpass USD 10 billion by 2032, growing at a CAGR of over 13% during the forecast period.

Crop monitoring technologies have emerged as vital tools in modern agriculture, enabling farmers to optimize yields, reduce resource consumption, and increase operational efficiency through the power of data-driven decisions. As the agricultural industry embraces digital transformation, the role of crop monitoring systems—powered by IoT, drones, sensors, and AI—is becoming indispensable.

Market Estimation & Definition

The Crop Monitoring Market refers to a broad set of technologies and solutions designed to assess and manage crop health, soil conditions, weather impacts, and yield predictions. These include aerial imaging via drones, satellite monitoring, in-ground sensors, farm management software, and data analytics platforms.

In 2024, the market size reached approximately USD 3.3 billion, up from USD 3.0 billion the year before. Forecasts indicate consistent double-digit growth, driven by the need to increase agricultural productivity sustainably. By 2032, the market is anticipated to exceed USD 10 billion, supported by both developed and developing economies integrating smart farming solutions to combat climate variability and food security challenges.

To access more comprehensive information, click here :https://www.maximizemarketresearch.com/request-sample/148144/

Market Growth Drivers & Opportunities

Technological Advancement in Agriculture

A major force driving market growth is the rapid development of precision farming technologies. Tools such as remote sensing, GPS-enabled tractors, UAVs, and AI-based analytics allow farmers to make timely decisions regarding irrigation, fertilization, and pest control. These innovations lead to reduced waste, optimized yield, and improved environmental impact.

Rising Demand for Food Security

With the global population expected to approach 10 billion by 2050, agricultural output must increase significantly. Crop monitoring technologies enable farmers to maximize efficiency on existing farmland, reducing the need for expansion into fragile ecosystems while ensuring a steady food supply.

Environmental and Climate Pressure

Changing weather patterns, increasing temperatures, and more frequent extreme events are compelling farmers to invest in solutions that provide real-time visibility into field conditions. Crop monitoring systems help mitigate risks by offering early warnings about drought, floods, pest outbreaks, or disease onset.

Government Support and Private Sector Investment

Various countries are introducing subsidies, tax benefits, and pilot programs to promote digital agriculture. Additionally, venture capitalists and agritech firms are investing in the development of cost-effective and scalable solutions, increasing market access for small and mid-sized farms.

Expansion of Internet and Smart Devices in Rural Areas

As internet penetration improves in rural areas, even smallholder farmers are beginning to adopt mobile-based applications and sensor-based tools to track crop health. This widespread digital adoption is creating new opportunities for market expansion in emerging economies.

Segmentation Analysis

The crop monitoring market is segmented by offering, technology, application, and farm size. Each segment contributes uniquely to the industry’s overall growth and diversification.

By Offering

Hardware: This includes equipment like drones, soil and weather sensors, GPS devices, and imaging systems. Hardware remains the dominant segment, as these physical tools form the foundation of most crop monitoring operations.

Software: Encompasses farm management platforms, mobile applications, data analytics engines, and visualization tools. Software adoption is growing rapidly due to the increasing need to interpret collected data and provide actionable insights.

Services: Includes deployment, consulting, integration, support, and maintenance. Service providers play a critical role in helping farmers adopt and scale crop monitoring solutions, especially in regions with low digital literacy.

By Technology

Sensing and Imagery: The most widely used technology, incorporating satellite imaging, drone surveillance, and field sensors that collect data on crop health, soil moisture, and pest infestations.

Variable Rate Technology (VRT): Allows for the precise application of inputs like water, fertilizer, and pesticides based on the needs of different field zones, optimizing input usage.

Automation and Robotics: Includes self-driving tractors, automated irrigation systems, and robotic weeders. These technologies are gaining traction, particularly in large-scale commercial farms.

By Application

Field Mapping: Enables the digital mapping of farmlands, identifying variations in topography, soil type, and productivity.

Crop Scouting and Monitoring: Real-time evaluation of crop conditions to detect signs of disease, pests, or stress.

Soil Monitoring: Tracks moisture levels, pH, and nutrient content, helping farmers make informed decisions about fertilization and irrigation.

Yield Monitoring: Provides insights into expected harvest quantities, enabling better supply chain planning.

Weather Tracking: Incorporates forecasting models and sensor data to help prepare for upcoming weather events.

By Farm Size

Small Farms: Traditionally slower in adoption due to cost barriers, but increasing affordability and mobile-based tools are bridging the gap.

Medium Farms: Represent the fastest-growing segment, as they are financially capable and operationally ready to adopt smart systems.

Large Farms: Early adopters of advanced technologies like robotics and AI-powered platforms due to high labor costs and scalability needs.

Request Sample :https://www.maximizemarketresearch.com/request-sample/148144/

Country-Level Analysis

United States

The U.S. continues to dominate the North American crop monitoring market. With a well-established agri-tech ecosystem, high adoption of precision farming, and strong R&D support, American farmers have access to cutting-edge hardware and software solutions. Government initiatives further encourage sustainable agriculture practices, increasing the deployment of satellite monitoring and predictive analytics tools across various states.

Germany

Germany is a leader in Europe’s smart agriculture sector. The country’s commitment to environmental sustainability and efficient farming practices has led to widespread adoption of soil monitoring sensors, automated irrigation systems, and drone surveillance. Government-funded initiatives and research collaborations between universities and agribusinesses are accelerating the uptake of AI-driven farm management solutions in rural areas.

Commutator (Competitive) Analysis

The crop monitoring market is highly competitive, with a mix of established agricultural machinery companies and emerging agritech startups.

Key Industry Players

John Deere and AGCO have integrated advanced crop monitoring sensors into their machinery, offering complete smart farming solutions.

Trimble and Topcon are leading GPS and sensor providers with robust analytics platforms.

Climate Corporation and CropX offer cloud-based platforms that combine satellite imagery with AI for real-time insights.

Strategic Trends

Product Innovation: Companies are focusing on integrating hardware, software, and AI into seamless platforms to deliver end-to-end solutions.

Partnerships: Collaborations between agritech startups and major agricultural equipment manufacturers are on the rise, enabling faster tech adoption.

Regional Expansion: Key players are entering emerging markets through joint ventures, localized product lines, and scalable pricing models.

Challenges

High Initial Costs: Equipment and infrastructure costs can deter smallholder farmers from adoption without external support.

Data Security: Concerns over data privacy and ownership can impact user trust and regulatory compliance.

Fragmentation: A lack of standardization across hardware and software platforms can limit integration and scalability.

Conclusion

The global Crop Monitoring Market is poised for substantial growth over the next decade. As agriculture faces increasing pressure to produce more with fewer resources, crop monitoring technologies offer a practical path forward. From detecting early signs of disease to maximizing yield with surgical precision, these tools are redefining modern farming practices.

With strong momentum across hardware, software, and services, the market is evolving rapidly. The convergence of AI, IoT, robotics, and cloud computing will continue to reshape how crops are managed, monitored, and harvested.