Insurance audits are an important part of property management, ensuring that safety systems meet required standards and that risks are minimized. Fire alarm systems are a critical component of these audits, and verifying their compliance is essential for insurance coverage and risk management. A properly verified fire alarm system demonstrates that a property meets local regulations, national codes, and insurer requirements. In this blog, we will explore the steps, best practices, and key considerations for verifying fire alarm system compliance during insurance audits.

Introduction to Fire Alarm System Compliance

Fire alarm system compliance refers to adherence to applicable codes, standards, and regulations designed to protect life and property. Compliance includes proper installation, maintenance, testing, and documentation. Insurance companies often require proof of compliance during audits to confirm that the property is adequately protected against fire risks. A compliant fire alarm system not only ensures occupant safety but also helps property owners avoid penalties, legal liabilities, and potential denial of claims.

Understanding Applicable Standards and Codes

The first step in verifying compliance is understanding the relevant codes and standards. These may include local fire safety regulations, building codes, and national standards such as NFPA 72 in the United States. These standards define requirements for system design, detector placement, notification devices, control panels, maintenance schedules, and record keeping. Knowing the applicable standards ensures that inspections and verifications are aligned with insurance and regulatory expectations.

Documentation and Record Keeping

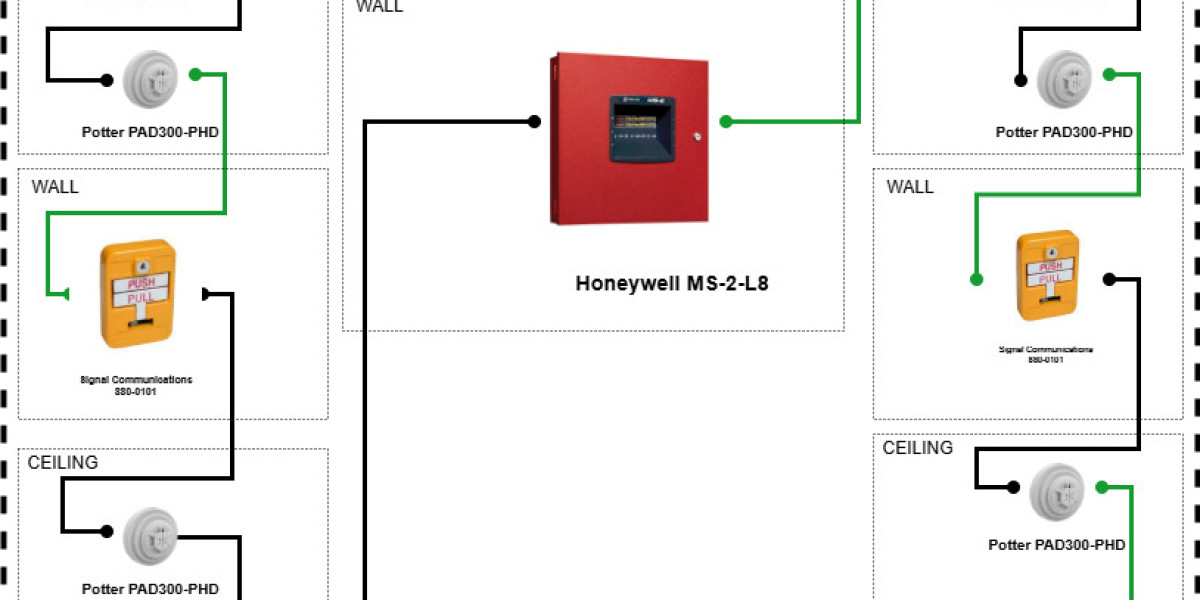

Proper documentation is a key aspect of fire alarm system compliance. Maintain records of system design, installation, commissioning, maintenance, and testing. These records should include device locations, system schematics, inspection reports, service logs, and any modifications made to the system. During insurance audits, documentation serves as proof that the system has been installed and maintained according to standards. Accurate record keeping also helps identify potential issues before an audit and supports ongoing system management.

Regular Testing and Maintenance

Insurance auditors typically expect fire alarm systems to be tested and maintained regularly. This includes monthly, quarterly, and annual inspections depending on local regulations and manufacturer recommendations. Regular testing verifies the functionality of smoke detectors, heat detectors, manual call points, notification appliances, and control panels. Maintenance ensures that all components are operational and that any faults are promptly addressed. Documenting these activities is essential for demonstrating compliance during audits.

Engaging Certified Fire Safety Professionals

Verifying compliance often requires professional expertise. Certified fire safety technicians or licensed contractors can perform thorough inspections, testing, and maintenance. They can confirm that devices are installed correctly, that wiring and circuits meet standards, and that the system functions as intended. Professional reports from certified technicians carry weight during insurance audits and provide assurance that the system is compliant.

Performing a Pre Audit Review

Before an insurance audit, conduct a pre audit review to identify potential compliance gaps. Check that all detectors, notification devices, and control panels are working correctly. Review documentation, service logs, and test reports. Ensure that system modifications or expansions have been properly recorded and verified. A pre audit review allows property managers to address issues proactively, reducing the risk of non compliance findings during the actual audit.

System Inspections and Functional Tests

Insurance auditors may perform physical inspections and functional tests of the fire alarm system. This includes activating detectors, testing alarm sounds, verifying panel displays, and ensuring that communication lines to monitoring services are active. Functional testing confirms that the system responds correctly to fire events and that emergency signals reach monitoring centers or local authorities. Prepare the system and staff for these inspections to demonstrate operational readiness.

Addressing Deficiencies Promptly

If deficiencies are identified during inspections or pre audits, address them promptly. Replace faulty detectors, repair wiring issues, and update documentation. Some deficiencies may require system recalibration or software updates. Correcting issues in a timely manner shows insurers that the property is committed to maintaining a compliant and functional fire alarm system. This proactive approach can prevent penalties or coverage complications.

Integration with Other Safety Systems

Many modern fire alarm systems are integrated with other building management and safety systems, such as sprinklers, access control, and emergency lighting. Verify that all integrations are functioning correctly and that alerts are coordinated. Integrated systems enhance safety and provide additional proof of compliance, which is valuable during insurance audits. Ensure that testing includes these integrated components to demonstrate system reliability.

Training and Staff Awareness

Auditors may also assess staff readiness and knowledge regarding fire alarm system operation. Ensure that building occupants, security personnel, and facility managers are trained on alarm response procedures, evacuation plans, and system reporting. Staff awareness is a key part of compliance, as a system alone cannot guarantee safety without proper human response. Training records should be documented and available for review during audits.

Leveraging Technology for Compliance

Advanced fire alarm systems often include digital monitoring, remote access, and automated reporting features. These capabilities simplify compliance verification by providing real time status updates, test logs, and maintenance alerts. Using technology can streamline the audit process, reduce manual record keeping, and enhance overall system reliability. Ensure that digital tools are configured correctly and that data is accessible for audit purposes.

Conclusion

Verifying fire alarm system compliance for insurance audits requires a combination of proper installation, regular testing, accurate documentation, professional inspections, and staff training. Following regulatory standards, maintaining records, and addressing deficiencies proactively ensures that your property meets insurance requirements and is prepared for audits. XTEN AV provides expertise and solutions for fire safety and compliance, helping property owners maintain fully functional and compliant fire alarm systems that protect lives, property, and investment.