Today, the convenience of using credit cards comes with hidden threats that most people aren't aware of. Bclub, an underground term often tied with dumps and CVV2 shops, represents a digital black market where stolen credit card data is sold. But what does this mean for everyday card users?

These dumps and CVV2 shops are not visible to the average online shopper. They're part of hidden networks where cybercriminals exchange stolen data for profit. A “dump” refers to the data pulled from a card’s magnetic stripe, used to clone physical cards. The CVV2 code, on the other hand, allows online purchases, making both types of information extremely valuable to fraudsters.

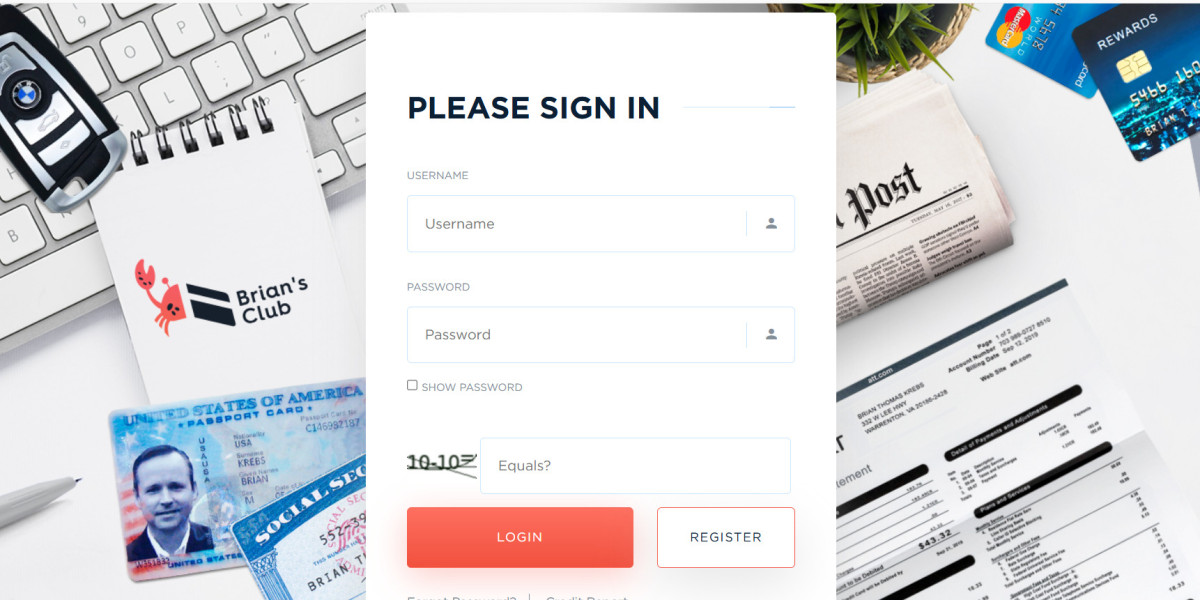

Platforms like Bclub provide a structured way for criminals to access this data. They operate much like a typical e-commerce site, but instead of selling clothes or gadgets, they sell stolen card data sorted by location, balance, and bank type. These details help buyers target high-value cards that are more likely to be used before being blocked.

The ease of access to such tools makes credit card fraud disturbingly efficient. Once your card is compromised, the stolen details can be listed on Bclub within minutes. From there, they can be bought by someone halfway across the world who will use them to make purchases, often draining accounts before the victim notices anything wrong.

The rise in fraud cases shows how widespread the issue has become. Even big banks struggle to keep up with the constant wave of stolen data being traded online. While they do provide fraud alerts and monitoring tools, they can't stop every case.

So, what can you do to stay safe? First, avoid public Wi-Fi when making purchases. Criminals can intercept your data on unsecured networks. Second, be careful about where you enter your card details. Always check if a site is secure and well-known. Third, keep a close eye on your statements. The faster you spot an issue, the easier it is to resolve.

Bclub’s involvement in these shady dealings shows how advanced and organized digital crime has become. The average person may never visit these shops, but the danger is still real. The only way to stay ahead is by being cautious, informed, and ready to act if something goes wrong.

In the end, credit card users must understand that their financial information is valuable — not just to them, but to criminals too. Taking steps to protect it is no longer optional, it’s necessary.